Overview

Develop a smart fundraising strategy

1h 29min

Course nuggets

About this course ...

Develop a smart fundraising strategy

Learn about the process of fundraising, including how to analyse your funding needs and identify different sources of funding. This course explains the pros and cons of investment, awards, grants, crowdfunding and loans and includes interviews with founders about their experiences raising funds from these different sources, plus a 7-part canvas that you can use to analyse your funding needs and identify funding sources.

Created by Ben Graziano.

Learn - core concepts

A short animated clip introducing the topic of fundraising and the different types of funding available to a startup.

Hear - advice from founders

In this video, founders from a variety of industries share their experience in the important issue of fundraising.

Laurent Coulot, CEO of Insolight, explains their fundraising strategy and offers advice on raising money from investors.

Laurent Coulot, CEO of Insolight, offers his advice on how to secure grants and shares a few tips and lessons.

Laurent Coulot, CEO of Insolight, offers advice on how to raise money from investors and shares a few tips and lessons.

Michael Noorlander, co-Founder of Neon, explains their fundraising strategy and offers advice on convincing investors.

Michael Noorlander, co-founder of Neon (mobile bank account) talks about the importance of early fundraising.

Michael Noorlander, co-founder of neon (mobile bank account) shares some advice on fundraising in the fintech industry.

Florent Héroguel, COO of Bloom Renewables, explains their fundraising strategy and shares advice on raising money.

Daniel Meppiel, co-founder of WeGaw, explains their fundraising strategy and gives tips on raising money from investors.

Daniel Meppiel, co-founder of WeGaw, offers his advice on how to raise money using equity crowdfunding.

Daniel Meppiel, co-founder of WeGaw, offers his advice on how to secure grant funding and shares a few tips and lessons.

Simon Michel, CEO of Prognolite (forecasting tool for restaurants) talks about the different ways to find investors.

Manuel Seiffe, CEO of MPower (clean energy in emerging markets) gives advice on how to approach fundraising in B2B.

Manuel Seiffe, CEO of MPower (clean energy in emerging markets) talks about various fundraising strategies.

Manuel Seiffe, CEO at MPower (clean energy in emerging markets) talks about their specific fundraising decisions.

In this video, Edith Schmid, co-founder at epyMetrics AG explains how to apply for grants.

Edith Schmid, co-founder at epyMetrics AG talks about the importance of narratives, coaches and crossfunding.

In this short clip, Edith Schmid, co-founder at epyMetrics AG provides insight into the fundraising process.

Anastasia Hofmann, co-founder at Kitro talks about their approach to fundraising.

Anastasia Hofmann, co-founder at Kitro lays out how to get initial funding for your startup.

In this video, Alina Russ, CEO of Lola's Kitchen, shares her personal fundraising experience.

Here, John Klepper, CEO of PIPRA, talks about fundraising in medtech and the value of data.

Explore – optional knowledge from the web

Successful entrepreneur Jay Adelson explains what the different rounds of startup funding are called and why.

Mikael Thuneberg, founder of Supermetrics discusses the pros and cons of bootstrapping versus taking investment.

An introduction to the four main types of crowdfunding: equity-based; debt-based; rewards-based; and donation-based.

Convertible notes are a great way for early-stage tech companies to raise capital, but how do they work?

The top 7 ways that both investors and founders can value an early-stage startup.

Startup guru Seth Godin explains how nonprofits can use storytelling to spread their mission and raise funds.

Find out about the major aspects of shareholders' agreements, including term sheets, investment agreements etc.

Two lawyers share their perspectives of why a Shareholders' Agreement is important and what aspects it should include.

Learn how to incentivise and motivate team members by using Employee Stock Options.

Find out how Venture Capital (VC) investors make money and what this means for founders.

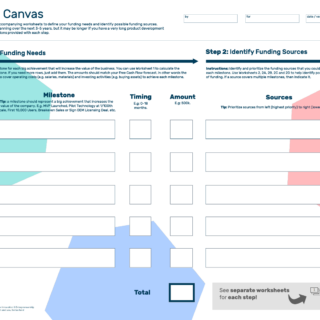

Apply - tools

A 7-part canvas that you can use to assess your funding needs and identify different sources of funding.

Here we provide a short summary of investor jargon terms, their definitions and their common synonyms.

Filtering